Explain the Differences Between Tariff and Quota

Differences Between Tariffs And Quotas. If a company wishes to export 5000 shoes to a nation with strict trade policies the government may impose a tariff or a quota on the business.

Quotas Versus Tariffs Hinrich Foundation

Tariff Barriers implies the tax or duty levied by the countrys government on the import of goods from a foreign country so as to restrict imports to a certain extent.

. Quotas cripple the bargaining strength of importers. In this type of tariff the consumer shall be charged with different prices for a different level of consumption. Using demand and supply diagrams explain the major welfare differences between tariff and quotas.

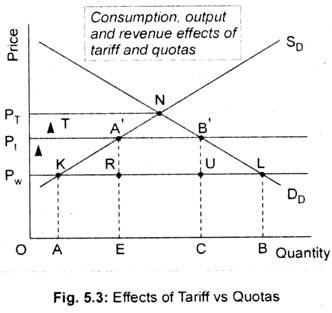

A tariff directly adds to public revenue while a quota does not. No longer charges tariffs on imports of steel and aluminum from the European Union. A trade subsidy to a domestic manufacturer.

2Tariffs earn revenue for the government and increase the GDP of the country while quotas are for the number of the products traded and not. Though both of these trade limitations inhibit the free flow of goods and services between borders these restrictions are fundamentally different. It specifies the maximum amount that can be.

Who are the experts. 25 points Expert Answer. Tariffs are a charge levied on the value of goods imported from another countryQuotas and tariffs are both used to protect domestic industries by artificially raising p.

Quotas restrict the quantity of a good imported from another country. 1Tariffs are the taxes imposed by the government of a country on import and export products while a quota is the limitation imposed by the government on the number of goods that can be either exported or imported. And of a quota on the surplus of the actors involved 10 points.

It is normally imposed by the government on the imports of a particular commodity. While both tariff and quota are restrictive trade policies meant to protect domestic producers they differ in their ways. Tariffs can be defined as duties or forms of taxes levied on goods for revenue and protective purposes when they are.

In short tariffs and trade barriers tend to be pro-producer and anti-consumer. Explain the differences and similarities between a tariff and a quota. Discuss the differences between tariffs and quotas.

On the other hand a quota is a quantity limit. A tariff is a tax on imports. Their administration and effects however differ in specific ways.

P FT is the free trade price. Consider Figure 728 Effects of a Demand Increase which depicts a small importing country. The difference between an import tariff and an import quota is relatively simple - a tariff is an amount that the importer needs to pay based on a percentage of the value of the goods.

Tariffs are a charge levied on the value of goods imported. It restricts imports of commodities physically. Tariffs are taxes and generate revenue for a government while quotas are.

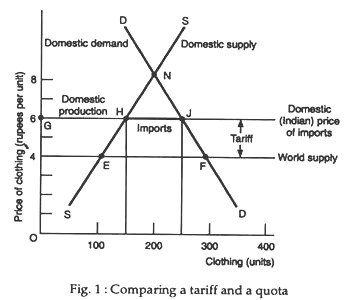

If a tariff of T is put into place the domestic price rises to P T and imports equal D T S TA quota set equal to Q T the blue line segment would generate the same increase in price to P T and the same level of imports. Key Differences Between Tariff and Non-Tariff Barriers The difference between tariff and non-tariff barriers can be drawn clearly on the following grounds. An Increase in Domestic Demand.

Tariff and quota 25 points a Explain the differences between tariff and quotas discussing the effects of a tariff. Understand the definitions of these policies their effects on the. What will this mean for citizens with respect to the price and quantity of baseball hats available in their country.

Suppose the President wants to ensure their country receives extra money from imposing either a tariff or a quota. How can this be used to improve your current economic position. Quotas and tariffs are both used to protect domestic industries by artificially raising prices in the domestic market.

It is a barrier to trade. Ask an expert Ask an expert done loading. We review their content and use your feedback to keep the quality high.

In what areas do you have a comparative advantage over your classmates. 5Explain the principle of comparative advantage. Step rate tariff is the most used type of tariff around the world.

In India almost 29 states use step rate tariff. B Assume Home is a small country and thus unable to influence the world price. A Answer- Quotas restrict the quantity of a good imported from another country.

The difference between quotas and tariffs. It instead adds to the profits of the suppliers particularly of the quota holders. A quota is a quantitative limit on an imported product.

As stated earlier administration of quotas entails additional resource cost for the government and the economy. Tariffs basically refer to a form of tax imposed on exports and imports and a quota refers to the limitations imposed on the quantity of products exported or imported. Because of this quotas are less frequently used than tariffs.

A tariff is a tax on an imported product that is designed to limit trade in addition to generating tax revenue. It is also called as slap tariff. One of the key differences between a tariff and a quota is that the welfare loss associated with a quota may be greater because there is no tax revenue earned by a government.

What is the difference between Tariff and Quota. Experts are tested by Chegg as specialists in their subject area. Tariffs and quotas are policies aimed to increase the prices of imported goods to promote the consumption of domestic goods.

No comments for "Explain the Differences Between Tariff and Quota"

Post a Comment